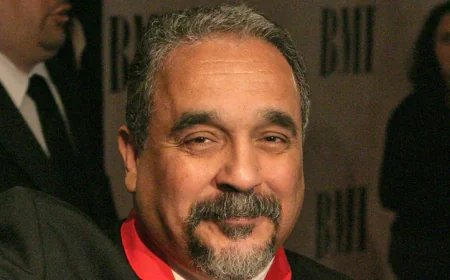

Salehuddin Optimistic About Curbing Inflation in Next Fiscal Year

Finance Adviser Dr Salehuddin Ahmed has said that the government is eying to curb the inflation rate further in the next fiscal year (FY26) although it might be a bit challenging task.

“We’re trying our best. Our agriculture sector suffered hugely last year due to the flood. However, we’re expecting a good harvest this time,” he said.

The Finance Adviser said this in an interview with the BSS at his office at Bangladesh Secretariat while highlighting the salient features of the upcoming national budget (FY26), which would also be the first of its kind for the interim government, headed by Nobel Laureate Chief Adviser Professor Dr Muhammad Yunus.

About the optimism of the government to contain inflation in the coming days, the Finance Adviser said they are hoping to contain inflation at 8 percent by December (2025) while by June next year it might come down at 6 to 7 percent. “But, it will take some time,” he added.

Since the Jatiya Sangsad is not in place now, the Finance Adviser would present the budget via televised speech, to be formalised through a presidential ordinance.

Officials familiar with the budget formulation process said that the government is likely to deliver a Taka 7,90,000 crore national budget for FY26 which would be Taka 7,000 crore smaller than the original budget size for the current fiscal year.

This will mark the first televised budget speech of the interim government since the fiscal year 2007–08, when former caretaker government Adviser AB Mirza Azizul Islam delivered two budgets in a row via national broadcast.

When asked how the government would face the challenges of containing inflation in the next budget and also to meet the demands in the priority sectors like education and health, Dr Salehuddin said that the inflation has now reached at a stable position although it had once shot up to around 11 percent, but now has come down at around 9 percent. “The non-food inflation is also there alongside the food inflation… but, the inflation rate is gradually coming down,” he said.

He said although the high inflationary trend persisted for a long, but it is now on the declining trend as the government had contained it during the Holy Month of Ramadan by pursuing various means like enhancing the supply side. “It’s now more or less stable,” he said.

Citing that challenges are there to curb inflation both in the demand side and in the supply side, the Finance Adviser said the demand side is being addressed by the tightening of the monetary policy while the supply side is being addressed by putting emphasis on the production side.

“Although attaining the target will be a challenging task, but hopefully we’ll attain that,” he added.

According to the Bangladesh Bureau of Statistics (BBS), the general point-to-point inflation rate in Bangladesh eased further in April, 2025 as it eased slightly to reach 9.17 percent in April, 2025 down from 9.35 percent in March, 2025.

The slight decline was mainly driven by downtrend in both food and non-food inflation.

In April 2025, the point-to-point food inflation declined to 8.63 percent, down from 8.93 percent in March, 2025, the BBS data showed.

Meanwhile, the non-food inflation rate also showed a slight decline reaching 9.61 percent in April, 2025, down from 9.70 percent in March, 2025.

The point-to-point inflation rate declined in both the rural and urban areas last month. In the rural areas, it was 9.15 percent in April, 2025 which was 9.41 percent in March, 2025.

Asked about the current trade and commerce as well as the revenue collection situation, the Finance Adviser said businessmen who have good track record are not facing any hassle in opening up of LCs.

But, those businessmen who have bad track record may face problems, he said, adding that those who have bad loans would not get the desired support from the banks. “It’s not like that the businesses now have come to a standstill,” he added.

Dr Salehuddin said the businessmen are now getting incentives since they are exporting goods.

Although the government did not receive any budget support from the IMF over the last eight months, the foreign currency reserves and the current account balance are not in a bad shape.

He said the central bank Governor has already indicated that the foreign currency reserves may reach $25 billion in this June and then gradually shoot up to $30 to $40 billion.

Dr Salehuddin, also the former Bangladesh Bank Governor, said that before the interim government took charge, the reserves at one point reached over $42 billion to $45 billion through artificial measures, which was not right.

He said the ideal foreign currency reserves depend on any country’s GDP situation, relationship with broad money and on debt service availability and having minimum reserve for meeting the import bills of three months.

“We think we’ve reserve enough for meeting the import bills for more than three months. We’ve also debt service liability. On the whole, the foreign currency reserves are now in a stable state,” he added.

The Finance Adviser noted that if the foreign currency reserves gradually climb up to $45 billion to $50 billion, then the situation would be more comfortable. “I’m hopeful that the reserve will increase further side by side more FDI is needed to boost it further,” he added.