Britain’s Largest Water Supplier Hit by Critical Rescue Setback

Britain's government Tuesday ruled out nationalising Thames Water after US private equity firm KKR decided against pumping vital investment into the country's biggest supplier of the commodity.Thames, which supplies around 16 million homes and businesses in London and elsewhere in southern England, is drowning in debt but had avoided a government rescue thanks to new loans and the promise of fresh investment.However in a unexpected announcement Tuesday, Thames said KKR would no longer invest billions of pounds to help keep the company afloat. The US group gave no explanation for the decision. Thames Water chairman Adrian Montague said that "whilst today's news is disappointing, we continue to believe that a sustainable recapitalisation of the company is in the best interests of all stakeholders".

He added in a statement that Thames continues to work with creditors and stakeholders to achieve such a goal. Later addressing parliament owing to the seriousness of the situation, Environment Secretary Steve Reed insisted that "Thames Water remains stable". He added that while the Labour government was not planning to renationalise the water sector -- whose ageing infrastructure is contributing to widespread pollution of rivers -- it is "prepared for all eventualities". Reed added: "We are not looking at nationalisation (of the sector), because it would cost over o100 billion of public money that would have to be taken away from other public services, like the National Health Service. "It will take years to unpick the current model of ownership, during which time pollution would get worse. And we know that nationalisation is not the answer."

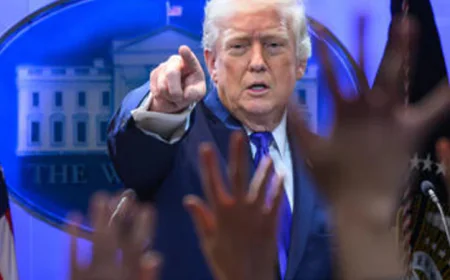

However since returning to power nearly one year ago, Prime Minister Keir Starmer's Labour has set about renationalising the country's train operators and recently provided a financial lifeline for Chinese-run British Steel. As for Thames Water, the company in March chose KKR as preferred bidder for a reported investment of o4 billion ($5.4 billion). A deal reportedly worth about one-quarter of Thames's debt would have handed KKR a majority stake, according to British media. The main opposition Conservative party blamed the government for the apparent U-turn by KKR. "According to a source close to KKR, one of the reasons they pulled out was because they were concerned about negative rhetoric directed at Thames Water and the rest of the industry in recent weeks by the secretary of state and other ministers," the Tories' environment spokesperson, Victoria Atkins, told parliament.

"In other words, the secretary of state and his ministers have talked themselves out of this rescue deal," she added. Thames recently secured a o3-billion emergency loan from creditors, giving it a short-term lifeline as it looked to attract takeover bids. The company has debts of almost o16 billion and last week was fined a record o123 million by UK water regulator Ofwat over pollution and improper dividend payments. Thames and other British water companies, privatised since 1989, have repeatedly come under fire for allowing the discharge of large quantities of sewage into rivers and the sea. This has been blamed on under-investment in a sewage system that dates back largely to the Victorian era. An interim report Tuesday from Britain's Independent Water Commission called for "wide-ranging and fundamental change" for the water sector in England and Wales.

This included "clearer direction from government" and "stronger regulation of water companies". Britain's public spending watchdog has said that the nation's water sector will need to pour o290 billion into its outdated infrastructure over the next 25 years to meet environmental and supply challenges. In late 2024, Ofwat approved a 35-percent hike to the average household's Thames water bill over five years, hitting consumers hard. Thames had sought an increase of 59 percent.