Venezuela Arrests 26 in Crackdown on Dollar Black Market

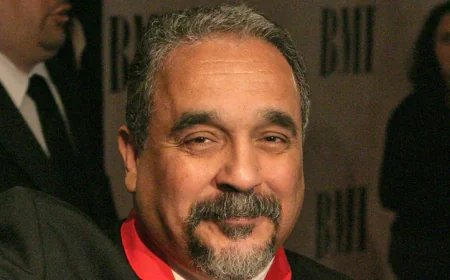

Venezuelan authorities have detained 26 people in a fresh crackdown on the dollar black market, bringing the total number of arrests in recent days to 50, the country's top prosecutor said Saturday. "The total number of detainees for economic crimes and illegal sale of foreign currency... is 50," Attorney General Tarek William Saab told AFP. The arrests come as Venezuela's government seeks to rein in a foreign exchange black market that developed after a 2018 decision to allow the use of US dollars to pay for goods and services in the country. That decision aimed to deal with the effects of runaway inflation that rendered the domestic currency, the bolivar, essentially worthless. The dollar has since then become the de facto currency in Venezuela. Caracas never opted for formal dollarization, and has instead pegged the value of the local currency to the greenback. The black market has swelled as high demand for dollars has far outpaced their availability through official channels.

For years, the black market was tolerated. Things changed in 2024 when the gap between the official and "parallel" rates expanded quickly, bringing fresh inflationary pressure for the oil-rich but chronically mismanaged and heavily sanctioned South American country. After months of stability with similar rates, the black market dollar had in recent weeks been trading between 25 and 50 percent higher than the official rate to the bolivar, before narrowing again. On Saturday, the official price was trading at $1 against 99.09 bolivares, while on the black market, the dollar was quoted at 115.37 bolivares, after soaring to 150 for some operators a few weeks ago. This gap in rates has raised fears of a return to hyperinflation, severe recession and shortages. The government, which had long ignored the black market, suddenly toughened its stance, with mass arrests over what President Nicolas Maduro has dubbed the "criminal dollar." The rate gap has widened since Washington's decision to reverse an easing of the oil embargo imposed on Venezuela, pushing up prices and depressing the bolivar. The return to a "hard" embargo in effect deprives Venezuela of dollars on the international market, even as Caracas is rushing to inject millions of dollars into the market to prevent its exchange rate gap from widening.