BB Announces Updated Monetary Policy Guidelines

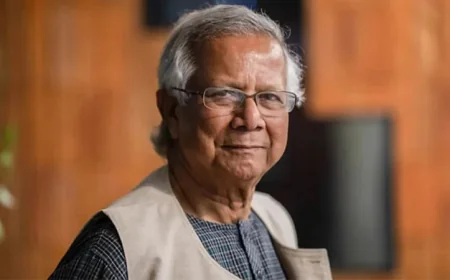

Bangladesh Bank (BB) has maintained its tight monetary policy stance for the first half of the current fiscal year 2025-26 (H1FY26) to contain inflation and anchor inflation expectations. BB Governor Dr Ahsan H Mansur announced the monetary policy for the first half of the fiscal FY26 at a press conference at the central bank headquarters in the city on Thursday.

“BB will continue its tight monetary policy stance in the first half of FY26 to contain inflation and anchor inflation expectations. If the inflation rate continues to decelerate further, as we expect, the policy repo rate may be adjusted downward, if inflation rate comes below 7% until then the policy repo rate will remain unchanged at 10.0 percent, the Standing Lending Facility (SLF) rate will remain at 11.5 percent, and the Standing Deposit Facility (SDF) rate will be 8.0 percent,” he said.

In his speech, the Ahsan H Mansur said the primary aims of this MPS are to decelerate the rate of inflation further while maintaining exchange rate stability and strengthening financial stability. Moreover, he said, global inflation is expected to ease due to weakening demand, currency volatility, and declining hydrocarbon prices. Therefore, central banks around the world may be more inclined to reduce interest rates or keep them steady at current low levels, given the dual context of weaker growth and lower inflation, he added.

Meanwhile, he said, world commodity prices are expected to decline in 2025 and 2026. The BB governor said that the central will continuously monitor inflation trends and the liquidity situation in the domestic market.