PPP Breakthrough:Bangladesh Secures $550m Greenfield Port Investment Without Adding Debt

Bangladesh has secured $550 million investment by Denmark’s APM Terminals, part of A.P. Moller Maersk, for implementing the Laldia Container Terminal at Chattogram Port, making it the largest European FDI and one of the largest PPP projects in the country’s history.

A ceremony to inaugurate the project andformally handover the Letter of Award (LOA) from Chattogram Port Authority (CPA) to APM Terminals and local equity partner QNS Container Services Ltd. was held at The Intercontinental Dhaka on Monday. The launch event joined by top dignitaries from Bangladesh and Denmark was jointly organized by Public Private Partnership Authority (PPPA) in partnership with APM Terminals and CPA.

Mr. Robert Maersk Uggla, Chairman of the world-renowned AP Moller Maersk Group arrived in Bangladesh for the event along with H.E Ms. Lina Gandløse Hansen, State Secretary, Trade & Investment, Ministry of Foreign Affairs of Denmark. APM Terminals, together with local partner, will jointly implement the project as part of a 30-year concession agreement. The Laldia Container Terminal will be fully financed, constructed and operated through private equity investment, with no debt burden on the government.

H.E. Mr Lars Løkke Rasmussen, Minister of Foreign Affairs of Denmark, while delivering a virtual message, said: “Mærsk has been a long-standing partner to Bangladesh and an important driver of the strong commercial ties between our two countries. Today the company handles almost 30 percent of all containers in and out of Bangladesh. The investment in Laldia container terminal by Mærsk-APMT’s is a powerful symbol of enduring and real partnership, and shows strong confidence in Bangladesh’s future.”

Keith Svendsen, CEO, APM Terminals said: “This greenfield project enables us to play an active role supporting the growth of the local manufacturers, exporters, importers, and the broader Bangladeshi economy. We are strengthening our commitment to the country with an aim of creating a safe and efficient terminal as well as creating skilled jobs for the future prosperity of the region.”

Rear Admiral S. M. Moniruzzaman, Chairman of the Chittagong Port Authority, said: “This terminal is coming at the moment when we are really hungry of capacity and hungry of efficiency. As you know Chittagong port is a river port and a feeder port. That's why the logistics cost is enormous. And if we want to be competitive, if we want to be relevant, then we need to compete with our real competitors. Otherwise, the higher valued products will not come to Bangladesh. That's why speed to market is our goal. And if we want to attain that goal, we need facilities like that of APM Terminals.”

M. Sakhawat Hossain, Hon'ble Adviser, Ministry of Shipping, said:“For years, congestion and longer lead-time have constrained Chattogram Port’s full potential. The new Laldia terminal will help decongest the port, allow larger vessels to call, and improve predictability for exporters. We welcome A.P. Moller Maersk’s global operational experience, which will help us solve the day-to-day bottlenecks our port users face,” said

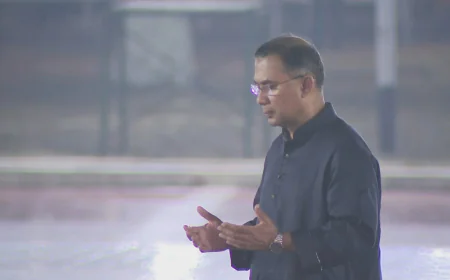

Ashik Chowdhury, CEO, PPP Authority said: “We have been able to demonstrate that PPPs in Bangladesh have moved from theory to genuine practice. We are on the way to getting a world-class operator without adding any government debt. The terminal is expected to increase Chattogram Port’s handling capacity by 44%. Projects of this nature gives us credibility with investors and it gives us the confidence that we can actually make a difference.”

Lutfey Siddiqui, the Chief Adviser’s Special Envoy on International Affairs, and Md. Touhid Hossain, Adviser, Ministry of Foreign Affairs, also graced the event.

Summary of the Laldia Container Terminal (LCT) CT PPP Project:

The Chittagong Port Authority (CPA) is entering into a concession agreement for 30 years of operations plus an extension tied to KPIs with APM Terminals B.V., a wholly owned subsidiary of A.P. Møller Maersk A/S (Maersk Group) - one of the world’s leading integrated logistics companies, majority-controlled by the A.P. Møller Foundation of Denmark, to design, finance, build and operate the Laldia Container Terminal (LCT) under a Public-Private Partnership (PPP) framework.

The ownership of the port will continue with Chittagong Port Authority (CPA), while APM Terminals & a local JV partner will only be responsible for design, construction, operations and management. This will reduce the capital expenditure burden for Bangladesh government.

APM Terminals B.V. is wholly owned by A.P. Moller – Maersk, headquartered in Denmark, the #1 country globally for anticorruption. It is one of the world’s leading terminal operators (more than 60 terminals in 33 countries), operating terminals in 10 of the world’s Top 20 best-performing container ports (World Bank, 2024). With extensive global experience across the world including East and South Asia (example: China, Singapore, Sri Lanka, Vietnam, and Malaysia), the Laldia project will introduce world class technology and operational excellence to Bangladesh, helping make the country’s logistics sector future-ready in the post-LDC era.

The newest green port will accommodate large container vessels (2x vs current size), reduce per-unit freight cost and enable direct shipping connectivity worldwide. Along with that 24/7 port operations with night navigation capabilities for ships with permissible length and draught will be enabled for the first time in Bangladesh. Developed under a revenue-sharing concession model, the project will generate a stable foreign-currency income stream for Bangladesh while minimizing public capital expenditure.

Key benefits:

1. Foreign direct investment (FDI): Under the Concession agreement, APM Terminals B.V. is expected to bring in Foreign Direct Investments (FDI)’s for an expected amount of about US $550 million via construction of a greenfield port terminal in Ladia, Chittagong. This will be the single largest European equity investment in Bangladesh to date.A marquee global investor such as APM Terminals entering the port sector also signals confidence to other international financers, crowding-in additional FDI to logistics, manufacturing, and ancillary services.

2. New container-handling capacity: The terminal is expected to add over 800,000+ TEUs per year (+44% vs current capacity). The terminal is expected to be commissioned by 2030. This will help relieve the current level of congestion at existing container terminals of Chattogram and providing headroom for Bangladesh’s fast-growing trade volumes.

3. Enhanced revenues for CPA & GOB: Higher throughput and efficiency gains from this LCT project will boost CPA’s annual revenues by receiving a Revenue in USD/TEU) for every container handled by APMT. In addition, there will be contribution from tax payments by APMT and additional revenue from ancillary marine services.

4. Large-scale job creation: Construction and operations from this Laldia Container Terminal (LCT) project are expected to generate over 500-700 direct and formal jobs plus several thousand indirect jobs in construction, trucking, warehousing, freight forwarding, and local SMEs

5. Global operating and safety standards: APM Terminals will apply internationally benchmarked health, safety, security, environment protocols, lowering accident rates and improving workforce wellbeing.

6. Latest technology transfer: Deployment of APM Terminals’ advanced technology in the construction of the port will modernize Bangladesh’s port infrastructure and build local technical expertise. The LCT terminal is expected to be a state-of-the-art modern operational terminal at the end of its construction period.

7. Lower Trade Costs & Faster Delivery for businesses: Global port operators such as APMT bring efficiency in port operations through - faster vessel turnaround, improved container dwell times via their operations which will result in a cut in the logistics costs for exporters and importers. Lower cost of shipping through reduced waiting time will help Bangladeshi exporters especially in time-sensitive sectors such as ready-made garments, agro-processing, and light engineering meet just-in-time delivery requirements, retain buyers, and compete more effectively in regional and global markets.

8. Workforce upskilling and knowledge transfer: APM Terminals’ in-house training programs covering equipment maintenance, digital terminal-operating systems, and international climate and Environmental standards will upskill Bangladeshi engineers, technicians, and managers. The creation of a locally trained talent pool raises productivity across the broader logistics sector and improves employability for Bangladeshi seafarers and port professionals abroad. APM Terminals is expected to deploy experienced personnels from other terminals to aid technology and process transfer (e.g.- Integration of LEAN methodology and FLOW operational process framework).

9. Catalyst for hinterland development: Throughput of over 800,000+ TEUs per annum will encourage private investment in inland container depots, cold chains, and industrial parks along Dhaka-Chattogram and other corridors spreading economic activity beyond port cities. The LCT project is expected to contribute towards the same.

10. Greener, more climate-resilient port infrastructure: The project will embed energy-efficient equipment and adopt other global climate practices, cutting carbon emissions and enhancing resilience to issues related to climate change. By aligning with global sustainability standards, the terminal supports Bangladesh’s Nationally Determined Contributions (NDC) under the Paris Agreement and positions the country to attract climate-smart investment in other infrastructure sectors.

11. Demonstration effect for Bangladesh’s broader PPP agenda: A successful long-term concession with a global operator such as APM Terminal signals that Bangladesh can structure, tender, and oversee complex public-private partnerships in line with international best practice. This track record is expected to lower perceived risk, broaden the pool of prospective investors, and catalyze additional PPPs in energy, transport, and social infrastructure helping close Bangladesh’s overall infrastructure financing gap.